Corona in the US Mushroom industry

The Corona virus has hit the USA very hard. With 1,5 million confirmed cases and 92.000 deaths registered on May 20th, it is the worst affected country in the world, due to its open economy and a slow reaction by the US government. End of April, mushroom consultant Ray Samp send us the following exclusive report on the impact COVID-19 had in the US (and Canadian) mushroom industry, which could not make it in our 100th print edition anymore.

By Ray Samp

Corona in the USA

COVID-19 is infecting the world and USA is not immune. Due to the rapid transport of people around the globe a new infectious disease can develop into a pandemic very quickly. Being geographically distant from the origin gives no immunity. The sophistication of the economy and the amount of air travel is directly linked to the degree of initial infection. The US being the biggest economy with the most per capita air travel makes us doubly susceptible to an infectious disease such as the coronavirus.

The degree of infection in the US has been very large, in part because of the amount of air travel from early infected countries. Of the measured cases and deaths via COVID-19 in the world, USA has ~25% of the cases and ~22% of the deaths, while only ~4.5% of the population. As such we have a huge problem and it is certainly affecting people’s behaviour and the behaviour of businesses. Although there has not been a national lock-down, many states have instituted stay-inside measures and all non-essential business have been closed. Beyond that public and private gatherings have been halted and non-essential travel discouraged. With 331 million of us staying indoors, consuming only what we need to live and no unessential purchases, the economy is in tail spin. Edible mushrooms are a part of that economy, and although things are bad in our industry, they could be worse.

Reductions

The American mushroom business is largely concentrated in the Kennett Square area of SE Pennsylvania. Over 50% of the national mushroom production is produced in this area and are transported coast to coast. The rest of the national production is on the west coast, mainly California, and other larger farms situated in middle America. There also is significant mushroom import from Canada and some from Mexico.

Because virtually all the restaurant and hotel trade has been lost, the food service segment of mushroom sales has been devastated. Institutional sales (low grade quality) is non-existent. Revenue from food service product lines has decreased 50-80%. With the American high production cost and low profit margins, that is unsustainable business. In this situation, growers that sell high percentage of their product to food service must cut production dramatically just to keep financially viable. Various farms have reduced compost fill by 33% or 50% or 67% up to 100%! Yes, operations are ceasing compost fill with a wait and see attitude. They are selling what product they have from crops in process and determine what will happen when the pandemic fades. Surely some of these mushroom farms will not reopen.

Farms that mainly sell to the retail market, have fared better, but are still under severe economic stress. When stay-at-home orders were being implemented demand for mushrooms declined rapidly. Being the perishable product mushrooms are, orders were cut and the normal flow of production to the pack houses had nowhere to go. As such pack houses had to dump hundreds of tons of mushrooms, or give them away when possible. At the farms, third flushes and more were cooked-off to avoid the cost of harvest and transport, thereby lowering productivity 15-30% along with corresponding revenue flow.

Rebound

Since the initial drop in retail sales, sales volume rebounded quickly. With restaurants closed and people staying indoors, home cooking has become in-fashion again and demand for mushrooms has been increasing. As such, pack houses are busy again and a few retail aligned farms are again harvesting third flushes, however secondary quality mushrooms go immediately into the trash and harvesting has become very tight to avoid secondary quality. As such, production is down on retail driven farms, but average price is generally up because of the high percentage of mushrooms sold into that higher price category. Still, the volume of all mushroom sales out of Pennsylvania is said to be off ~35%!

As is always the case to understand the effect of any economic phenomenon – follow the money. Farms whose sales conduit gives a decent return are hanging-on, those that have sold primarily to food service are having big trouble. Additionally, there is only so much volume that the retail market can absorb. A farm that has been producing for food service cannot rapidly shift gears and sell to the retail market because they don’t have the customer base to sell to. US retail sales is usually done on contract between large growers or pack houses with the retailers, so those on the outside cannot instantaneously sell to the retail market even if they have top quality (which some of them do).

On farms

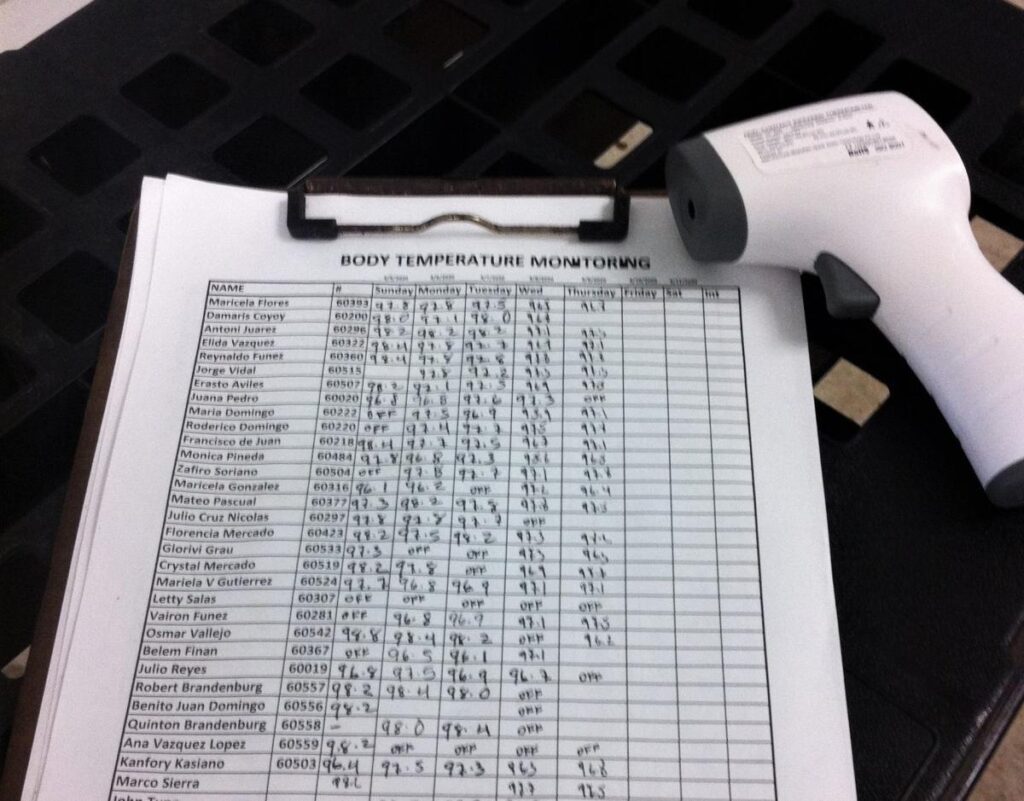

That is the sales side of the situation. On the farms it is operating as if Damocles’ sword were hanging over their heads. Even if a farm is fortunate enough to be able to sell their mushrooms into retail, they must adhere to the new reality of heightened health and safety awareness for the product and employees. Theoretically, a virus infected harvester could decimate any farm’s harvesting staff and effectively cause the farm to close. Because of this, stringent rules have been adopted to identify any sick employees and to enforce isolation policies while on the job.

The protocol varies from farm-to-farm, but the situation is causing more anticipation of circumstances than ever before. Some of the protocols include: temperature testing and documentation at the start of each day, social distancing during harvesting and all other operations, wearing masks and gloves, social distancing during breaks and lunch, staggered break and lunch schedules to accomplish the social distancing, adding a hygiene specialist to sanitize tables/chairs, food machines, door handles, tools, etc., special health screening of new hires, no visitors, etc. Of course, these efforts add cost and reduce efficiencies, but that is the cost of doing business in this time of crisis management.

Suppliers

Beyond the farms all raw material suppliers are affected as well. Commercial compost operations are reducing throughput from 10% to as much as 67%. Overall Pennsylvania compost production is down ~30%. Spawn companies, who also deal with a living organism with certain time constraints are seeing inventories build up. The chicken houses are overflowing with manure. They and peat moss, gypsum, supplement, and chemical suppliers are having their own problems, but at the end of the day, at least our industry is moving, albeit gingerly and very unevenly.

Economic stimulus

To aid in that staggering motion, the US government has passed an enormous $2.2 trillion (with a T) economic stimulus package to aid the populace and the business sector. In short it consists of payout of $1200 per adult and $500 per child to economically eligible citizens. This is to keep money in the economy and to keep many families afloat. As it relates to the mushroom industry, small business loans and tax credits are extended to businesses to keep people working and earning. These tax credits are offered for 100% of retained employee wages during the crisis. 100% credits are also available for 2 weeks of wages paid to employees who have proven infection of COVID-19 and must stay in isolation. Also, it offers 66% of average wage for anyone that is a proven caregiver of a family member or dependent for up to 10 weeks. This keeps money flowing into the economy, aids the employee, credits the business for taking care of their employees, and protects against infected employees coming to work because they need the income.

Canada

In Canada the mushroom business situation somewhat better because the per capita COVID-19 rate in Canada is much lower than the US. Since many farms sell into the US they are experiencing the some of the same sales dynamic. However, since Canadian farms generally sell into the retail sector, they are better positioned to minimize losses. Also, the currency exchange advantage they enjoy softens the blow. The home market has also contracted due to their own lock-down policies and restaurants will not open until 1 July! It is said Canadian production is off ~10-20% in eastern Canada and up to 20% in the west.

A secondary issue has been harvester availability. Many of the Asian harvesters are worried about COVID and attendance has suffered. However, to their credit the Canadian government has accelerated guest-worker processing about 5-fold to help in the labor situation. Although times are not as tough in the US, Nobody Escapes the reaches of this pandemic.

Hanging in there

As mentioned early on, things are bad, terrible for some, but they could be worse. At least we are producing a food product, which allows us to stay in business. As we all know, shutting down a mushroom farm/compost yard that is FULL of crops is a disaster. We are not there. Some lucky farms are treading water financially, while many others are accruing debt, but with some government help at least there is a chance of staying afloat. All of us are keenly aware that we must be able to adapt quickly to developing circumstances. The best we can do now is keep our house in cultural and clinical order and hope this thing runs its course quickly.